School Finance and Why Your Vote Matters Nov 5

Everyone knows that K12 public schools are always low on funds. A public school education isn’t free, as parents know because they still pay fees and help raise money through their PTA. Teachers spend their own money for supplies, and both teachers and principals write grants for special projects or even in-classroom books.

Why are schools so short on funding, especially in Colorado?

K12 school funding comes from various sources including the federal government, state, local residential taxes.

Federal Funding

Federal funds are about 8% of public school budgets, according to the U.S. Dept of Education. Federal funding covers things like Title 1: support for the economically disadvantaged and Head Start: support for early education, and Special Education. The states receive the funding and distribute it to school districts.

State and Local Funding

Put simply, public schools receive funding from the state and local residential taxes to fund a determined amount of funding per pupil. Colorado’s equation looks like this:

More detail can be found at School Finance in Colorado.

Big Discrepancies

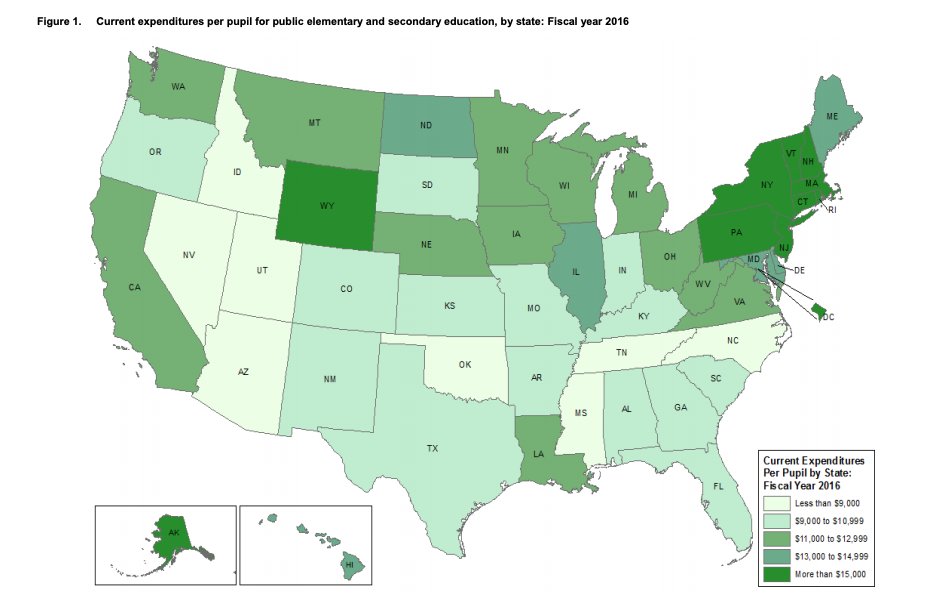

In fiscal year 2017, the national average per pupil spending by state was $12,201. New York had the highest expenditure of $23,091. States like Utah spend less than $9,000 per pupil. This map shows the 2016 expenditures by state:

Revenues and Expenditures for Public Elementary and Secondary Education: School Year 2015–16 (Fiscal Year 2016) First Look DECEMBER 2018 Stephen Q. Cornman National Center for Education Statistics Lei Zhou Activate Research, Inc. Malia R. Howell Jumaane Young U.S. Census Bureau

Colorado’s spending was ranked 39th in 2016, with an average of $9,575 spending per-pupil. Districts ranged from $7,983 to $18,807. And Summit County? A little above average at $13,119.

Why is Colorado Currently Spending so Much Less on Education?

In 1982, Colorado actually spent more per student than the national average. After that, Colorado has plummeted well below the average. There are several reasons why.

In 1982, Colorado voters passed the Gallagher Amendment to control rising property taxes. It established a permanent property tax ratio of 45% residential/55% commercial. The assessment rate was set at 29% for commercial with the idea that residential rates would float up or down to keep the ratio. Because of the housing boom over the last 30 years, the residential assessment rates have taken a dive to as low as 7%, as did the amount of revenue from property taxes. While the goal of Gallagher was to control increases of property taxes, which it has, at the same time it’s had a negative impact on public education.

Legislators believed at the time that to make up for the difference, counties and school districts could raise property tax rates. Which they did, until 1992 when TABOR (Taxpayer’s Bill of Rights) passed.

TABOR requires voter approval for any tax increase and sets limits on revenue collected by local and state government. Over the years, Summit County voters have approved additional taxes (called mill levies), which has been good news for the students and teachers.

In the last 10 years, oil and gas property values have grown even faster than residential. To maintain the Gallagher ratio, residential property taxes should have increased. But they didn’t because of TABOR limits.

Amendment 23, passed in 2000, requires the state to increase K12 per pupil base funding by inflation + 1%. In 2009, during the Great Recession when state lawmakers were faced with a budget crisis, they redefined the funding base. Starting in 2009, in order to make cuts from all districts, the legislature added a new “budget stabilization” or “negative factor.” The legislature now determines the state school budget, and then adjusts the negative factor to meet that funding target. Summit County has lost over $18 million in state revenue since 2009 due to the negative factor.

Where Per Pupil Funding Goes

In general (not citing Summit County specifically) about 7.4% of operating costs go to administration. About 60% goes to “instruction” which is mostly teacher salaries and benefits.

So it must be the teachers making all that money! Not a chance. In 2016-17, Colorado’s average teacher salary was $51,810. According to the National Education Association’s comparison of average teacher salaries across states, that results in Colorado ranking 31st in teacher pay.

Most of the remainder of the school budgets, 35%, goes to support services, like social work, counseling, curriculum development and training, transportation, and building maintenance.

The point is, there’s not much left for laptops, textbooks, or art supplies.

Summit Voters help with Bonds and Mill Levy Overrides

Voters have a major role in school funding. Mill levy overrides are property tax increases that schools can use for expenses like teacher salaries or new programs. Bonds also result in increased property taxes, but they are used to pay debt for construction and renovation projects.

This November 5th, there two ballot issues that will affect school funding:

4A

Education Foundation of the Summit is hoping you’ll vote YES.

4A will not increase your taxes. In 2007, Summit School District (SSD) was supported by the community in passing a Mill Levy Override to fund full-day kindergarten with local dollars. In Spring 2019, Colorado Legislature passed a bill to fund full-day kindergarten at the state level, which means that previously supported Mill Levy can no longer be collected. We need your support with a yes vote on Question 4A so SSD can continue collecting these funds, with no additional tax increase, and instead of using them for kindergarten, use them to:

- Attract and retain high quality teachers and staff

- Enhance school counseling and student mental health programs

Prop CC

A YES vote would allow the state to keep extra revenue collected, instead of returning it to taxpayers as required by TABOR. The extra money would go to K12 and higher education, and transportation. See the blue book with pros and cons (English or Spanish)

The lack of school funding is why EFS came into existence. We also help advocate for schools and bring community members in as partners to support schools and promote innovative programs. Please join us in supporting public education in Summit County.